Prefix AI, Nvidia and TSMC will dominate a slow 2025

By Peter Clarke

What’s at stake:

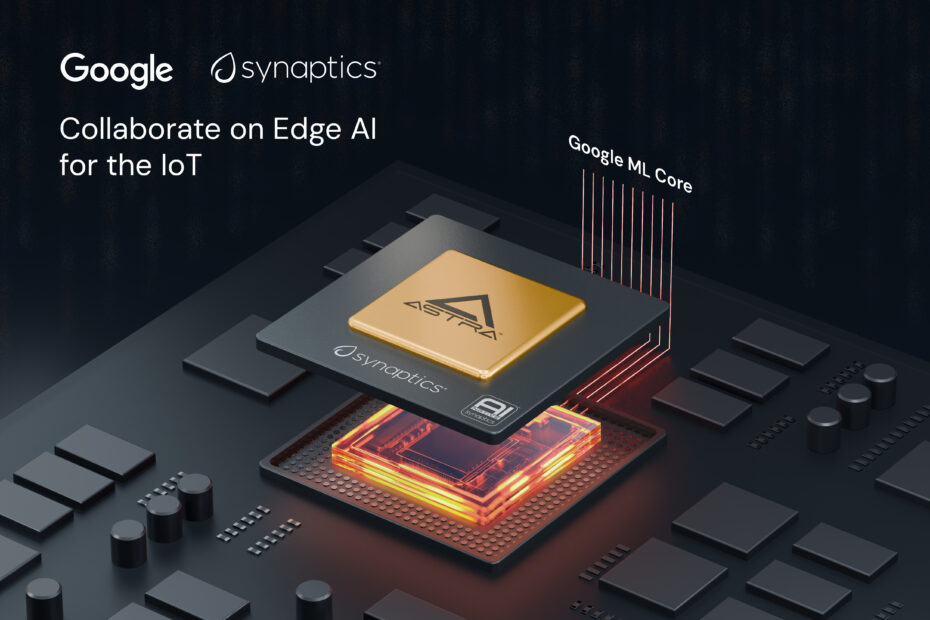

A new year and hope spring’s eternal. It should if you are working on AI-related technology. The rapid rise of different forms of AI – edge, hybrid, agentic and embodied or physical AI – means that Nvidia’s incumbency as semiconductor market leader is set to continue. For many others, the future is not looking so bright.

It would be all-too human to argue that the trend towards artificial intelligence that has been so strong over the last several years must be about to abate and allow some different innovation to be the forcing function for the technology sector in 2025.

The argument that exponential growth must end eventually is compelling. And it surely applies to the technology and to the semiconductor leader Nvidia.

And yet, while the annual doubling of revenue that Nvidia has shown will be hard to sustain, this human being thinks that AI will continue to be the driver of the semiconductor economy. Indeed, there is likely to be a renewed surge of interest in AI with the addition of prefixes such as edge, hybrid, agentic and embodied or physical.

Read More »Prefix AI, Nvidia and TSMC will dominate a slow 2025