Can Your 5G Handset Talk via Satellites?

By Ron Wilson

What’s at stake?

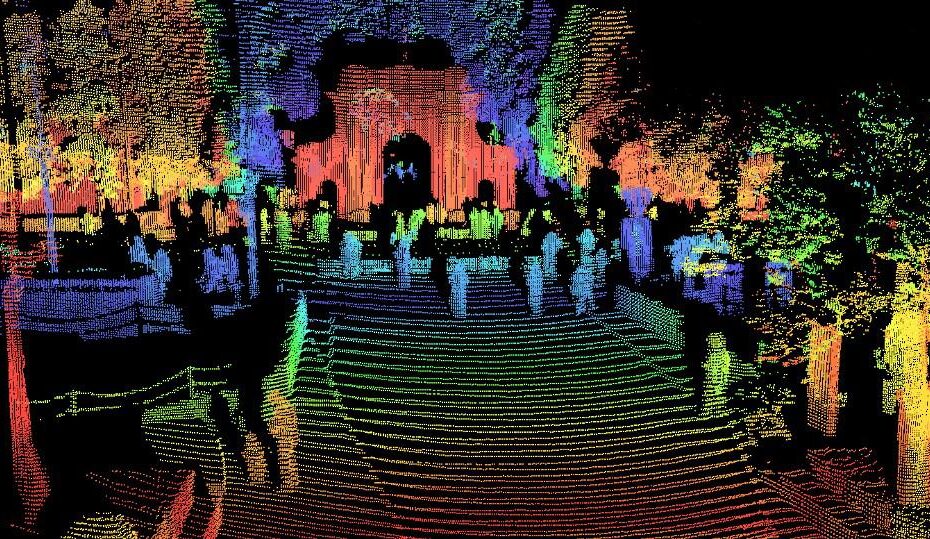

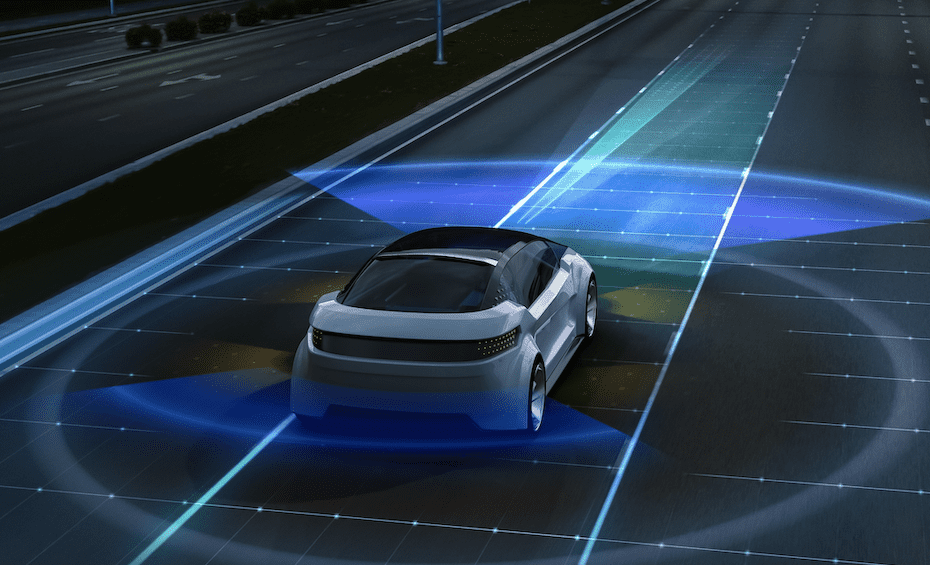

Major efforts are underway to build low-earth-orbit satellites that act as 5G base stations, communicating directly with conventional 5G handsets. Can this scheme work technically? And if so, can industry and governments sort out the labyrinth of business and regulatory issues it would create?

Imagine that your 5G smartphone would work anywhere—not just in the urban corridors where non-standalone 5G has been deployed today, but in rural villages, in the middle of nowhere, on planes, at sea: around the world. That vision is included within the international wireless standards body 3GPP’s recent Release 16. And it is the subject of accelerating research—and competition—among 5G technology suppliers and satellite communications providers.

Read More »Can Your 5G Handset Talk via Satellites?