By Peter Clarke

What’s at stake:

Is it a bird? Is it a plane? No, it’s Lip-Bu Tan coming to save struggling chip giant Intel Corp. But how? Whatever incoming CEO Tan has communicated to Intel employees, the company’s future cannot be business as usual. One possibility is that Tan was asked by the board if he is the CEO to execute on the existing ‘product-plus-foundry’ strategy and he said “Yes.” I doubt it. It is more likely Tan told the board he would only accept the role if he had complete freedom to operate, including the option to divest Intel’s manufacturing operations. Indeed, the fate of Intel’s manufacturing arm may have been decided even before Tan came on-board.

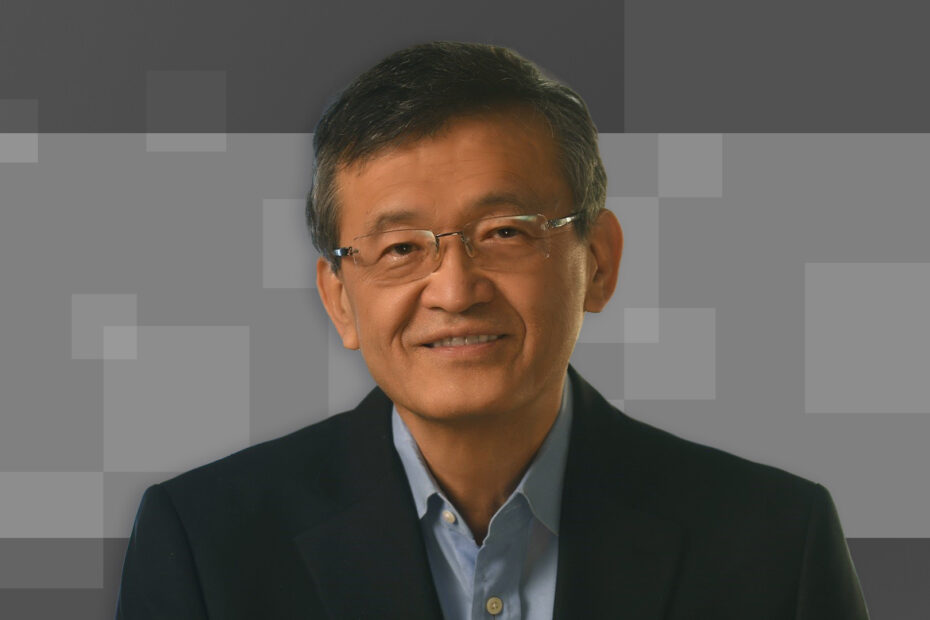

Veteran semiconductor executive Lip-Bu Tan has accepted the position of CEO at Intel Corp and is re-joining the board of directors after a six-month absence.

The highly-regarded Tan now comes back as the permanent CEO to replace Pat Gelsinger, who was ousted in December 2024. The financial markets clearly approved as on the news of Tan’s appointment Intel’s languishing share price popped by 12 percent.

Since the announcement of Tan’s appointment, many observers have picked up on a sentence in Tan’s message to Intel employees. He said: “Together, we will work hard to restore Intel’s position as a world-class products company, establish ourselves as a world-class foundry, and delight our customers like never before.” This has been taken as evidence that the ‘product-plus-foundry’ strategy continues at Intel.

I think that is a naïve reading of the situation. There is other evidence to consider.

Read More »Lip-Bu Tan must split up Intel