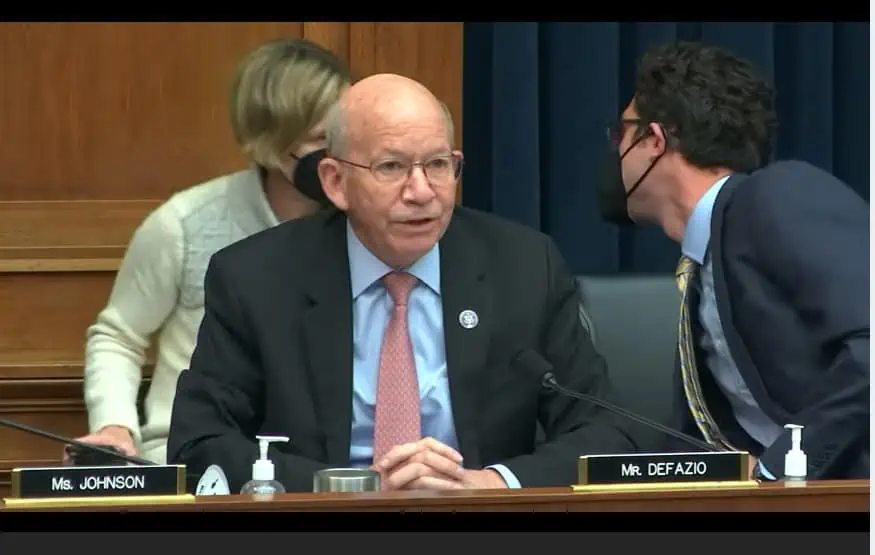

AV Hearing Sparks More Questions than Answers

What’s at stake?

Last week’s congressional hearing on autonomous vehicles (AV) exposed the limited knowledge among lawmakers on what automated vehicles are, let alone differences between AVs and Advanced Driver Assistance Systems (ADAS) — which look like disclaimers in the fine print for most people. The hearing could have used more discussion to clarify complex AV issues and elevate the debate beyond the talking points of special-interest groups.