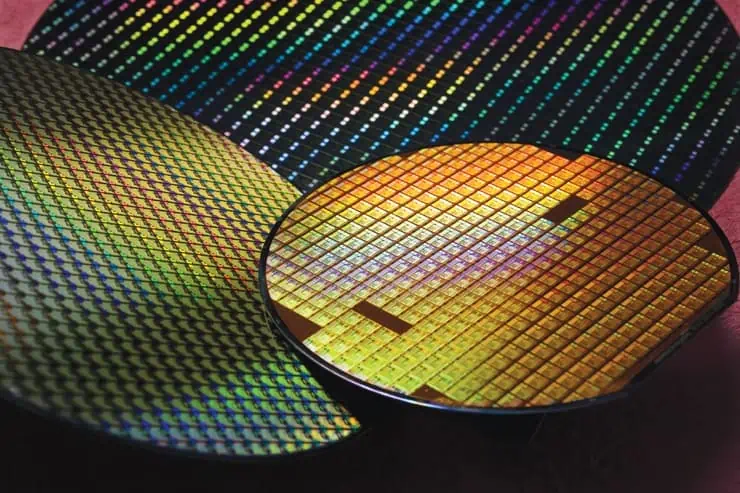

TSMC adds Diplomacy to its Chip Strategy, but at What Cost?

By Bolaji Ojo

What’s at stake:

TSMC says it will add more fabs in the United States, deviating further from its Taiwan-centric manufacturing strategy. It caved to pressures from American president Donald Trump, accepting that its business is mired in the bog of geopolitics and nationalism. This shift in the company’s standard operating system will come at a price, the possible loss of some operational efficiencies, for example. Is TSMC willing to pay this price or is it just attempting to deflect criticisms from Donald Trump?

Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC) was pandering to America’s cantankerous president. It was dissembling, too, despite – finally – making diplomatic moves to appease a powerful and unrelenting foe.

Everyone knew this, but most comments on TSMC’s March 3 announcement that it will more than double US capital expenditure were positive, applauding the foundry and touting the brilliance of a move hardly anyone had predicted or even thought reasonable weeks earlier.

The setting of the announcement itself should have raised red flags. At the White House, Donald Trump, accompanied by TSMC CEO CC Wei, said the Taiwan-based company would increase the number of semiconductor fabs it is building in the United States by 5, at a cost of $100 billion. This would bring the total of its latest capex investment in the country to $165 billion, Wei said. He then proceeded to thank Mr. Trump “again for his support.”

Read More »TSMC adds Diplomacy to its Chip Strategy, but at What Cost?