Chip Vendors Boost SDV Software. Is It Enough?

What’s at stake:

Renesas and NXP are rolling out software-defined vehicle development platforms. A platform encompassing hardware, software and cloud-based tools is a huge advancement compared to past offerings to the automotive industry. But no one dares to promise their effectiveness in a real world where OEMs design SDVs with hardware and software from multiple vendors.

To serve the plans of OEMs designing software-defined vehicles (SDVs), Renesas has unveiled an SDV development platform called “ROX” (R-Car Open Access),” boasting that it integrates “all essential hardware, operating systems (OS), software and tools” automakers need to rapidly develop next-generation vehicles “with secure and continuous software updates,” said Renesas.

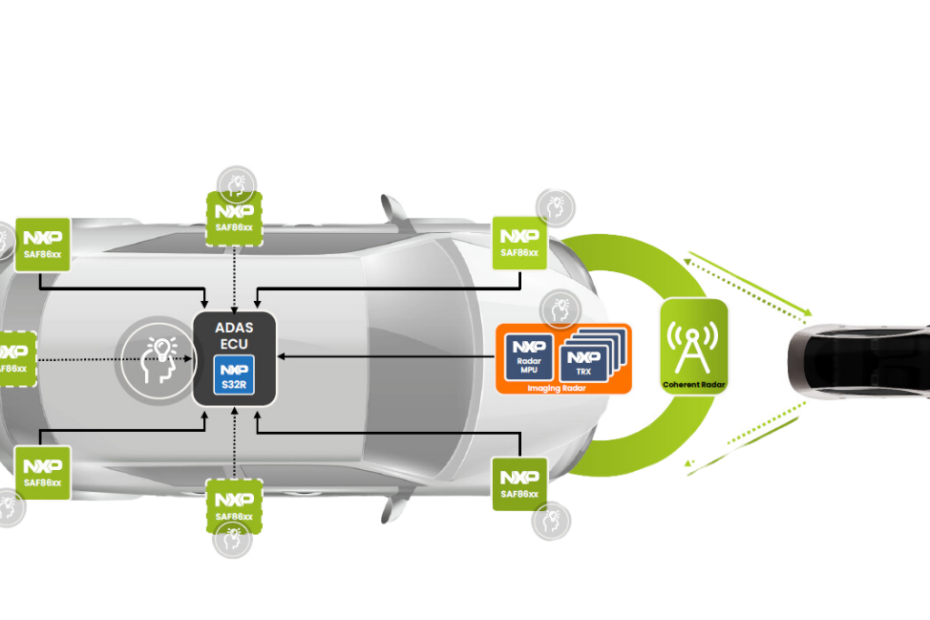

Similarly, NXP Semiconductors announced earlier this year “CoreRide” designed to address the complexity, scalability and costs carmakers face as they transition their creaky E/E architecture to newer software-defined vehicle architectures.

This initiative by the two leading automotive chip suppliers illustrates their urgent perception that they must minimize the impact of the software crisis facing many car OEMs.

Read More »Chip Vendors Boost SDV Software. Is It Enough?