Who Wants Rapidus in Silicon Valley?

What’s at stake:

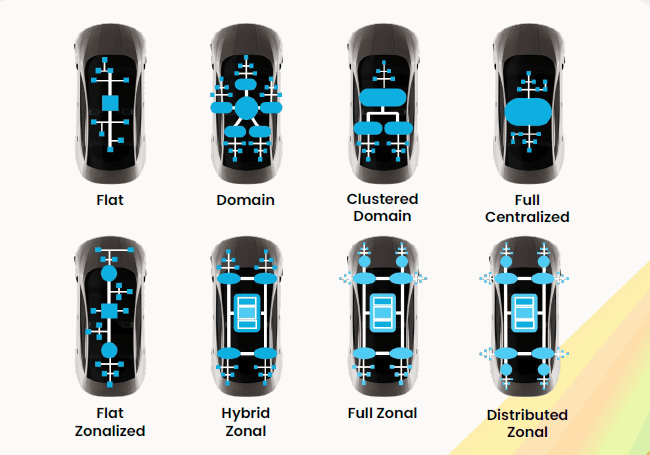

A lot rides on Japan’s first and only foundry company. Rapidus recently received an additional $3.9 billion in government aid. Included in the subsidies are a package that will help Rapidus grow into developing back-end packaging – in a country where no OSAT companies exist. Rapidus has yet to prove its 2nm process technology for front–end volume chip production. Is it trying to do too much?

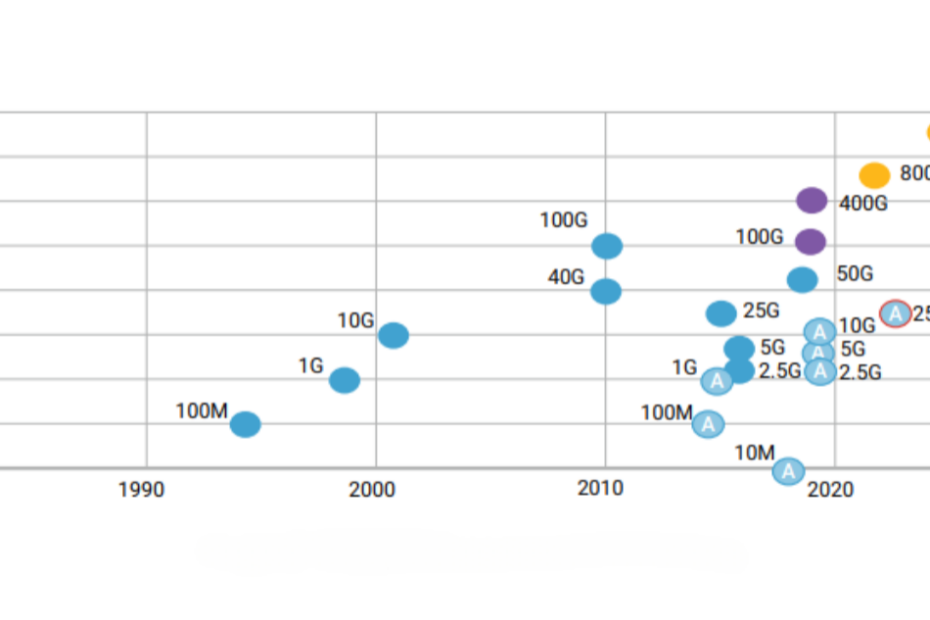

Many factors contributed to the eventual downfall of the Japanese semiconductor industry. The Japanese industry languished in the1990s largely because of the prolonged US-Japan semiconductor trade war. A mixture of hubris and obsession drove Japan’s pursuit of higher quality DRAMs, while paying little attention to the demand by PC manufacturers looking for “good enough” memory. (Japan missed the tide of a growing PC market.) Finally, Japan, which dominated the global semiconductor market in the ’80s with DRAMs – Japan’s specialty then – never succeeded in converting its technology prowess to microprocessors and logic devices.

Since then, the lessons Japanese government and semiconductor executives have learned could influence the outcome of Japan’s “renaissance” in chip manufacturing

Read More »Who Wants Rapidus in Silicon Valley?