Wolfspeed Ails but What Exactly Is the Problem?

By Bolaji Ojo

What’s at stake?

Wolfspeed Inc.’s market value is not in alignment with the positive stories about its position and profile in the silicon carbide market. In essence, its market dominance is not reflected in its market valuation. Wall Street is heavily discounting the stock. Why? Plus, with valuation this low, Wolfspeed is an appealing acquisition target. What’s stopping buyers from making a move?

Wolfspeed Inc., by all measures, should be the shiniest star in the silicon carbide (SiC) galaxy.

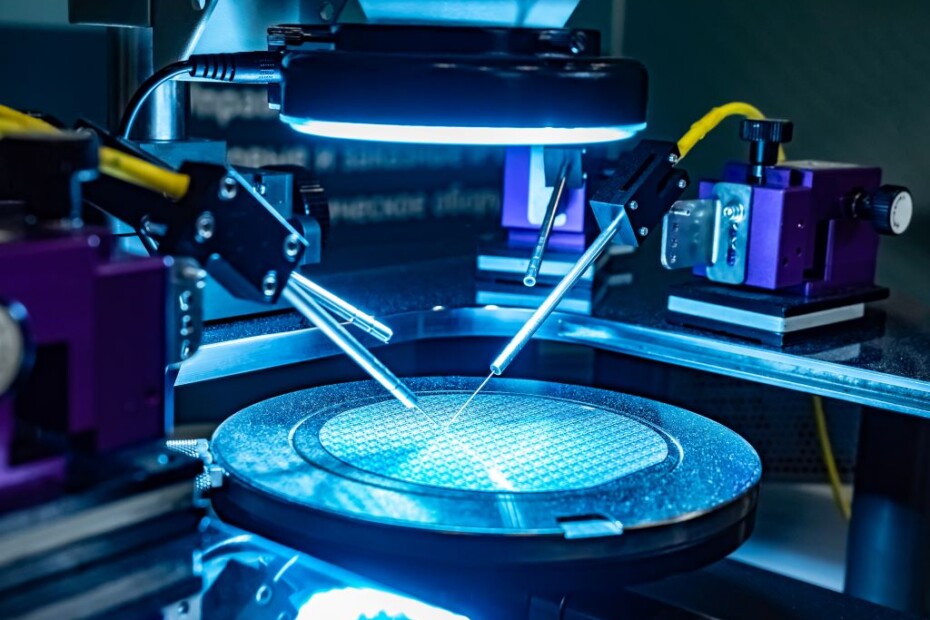

It prides itself as the “only pure-play vertically integrated silicon carbide company.” This means Wolfspeed is in the enviable position of owning, controlling and operating its own wafer-sourcing and production supply chain.

This vertical operating structure – a long abandoned system in the regular silicon semiconductor market – is a strength in the SiC segment, putting Wolfspeed in the uniquely advantageous position of being a prime beneficiary of the surging demand for SiC devices from the electronics, power and energy markets. Investors should be swooning over its stocks. They are instead paring back its valuation. There are a few reasons behind this, but none appear compelling. Do potential buyers of Wolfspeed shares know more than the average observer? Even this is not clear.

Read More »Wolfspeed Ails but What Exactly Is the Problem?