By Peter Clarke

The global market for MEMS components is on a course for a second consecutive year of growth and will be worth $16 billion in 2025 after it increased by 5 percent year-on-year in 2024 to reach $15.4 billion, according to market research firm Yole Group.

The 2024 increase followed a 3 percent decline in 2023 due to a drawing down of stock-piled inventory. The return to a steadier state has left the MEMS sector with a compound annual growth rate (CAGR) of 3.7 percent over the period 2024 to 2030, according to Yole, which has followed the MEMS market in detail for many years.

This CAGR is lower than at the beginning of the decade when Yole was forecasting increases of 9 percent per annum but reflects the increasing maturity of the MEMS market and of the mobile phone market which drove growth in the previous couple of decades.

For Yole, the long-term growth for MEMS is now expected to come on a broader front; the continued sensorization of consumer electronics, autonomous driving, enhanced comfort in cars, Industry 4.0, and the rise of AI. Of these, the pulling back of AI into the MEMS package has the potential to be highly significant, Yole indicated.

At $7.9 billion in revenue, consumer applications represented about half of the market in 2024. Industrial and automotive applications were tied in second place with $2.9 billion revenue each. Medical, telecommunications and defense made up the balance.

Bosch bounce

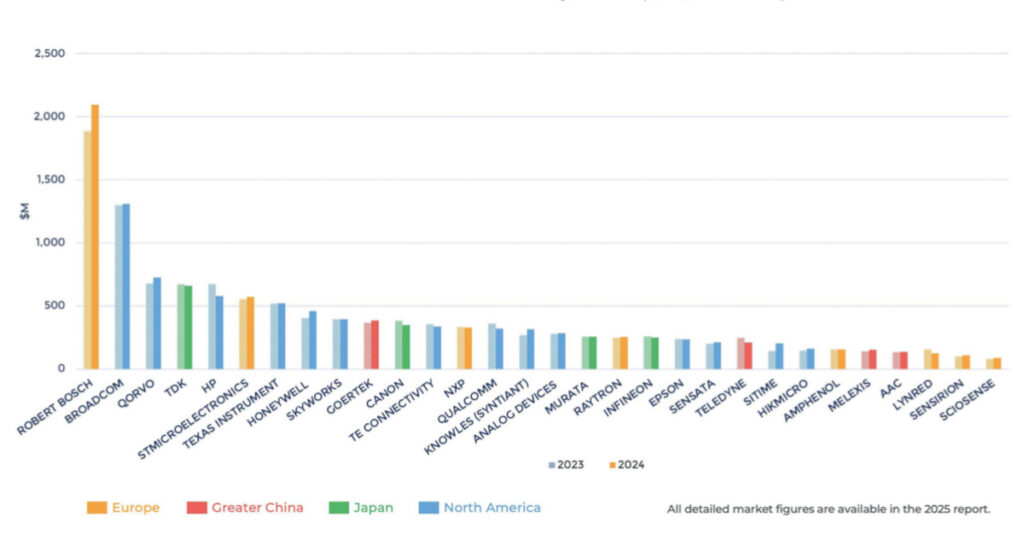

The market dynamic was beneficial for Bosch which increased its lead at the top of the ranking of MEMS vendors. Bosch’s MEMS revenues increased 12 percent and exceeded $2 billion in 2024. Second-ranked Broadcom was down at about $1.3 billion and third-ranked Qorvo down at about $700 million.

Bosch benefited from its smart sensor portfolio, which integrates intelligence to deliver value beyond basic sensing. Also, its positioning in high-end systems that were less affected during the downturn has shielded it from deeper volatility.

Broadcom and Qorvo mainly serve the smartphone and Wi-Fi markets with such technologies as thin-film bulk acoustic resonators (FBAR) and bulk acoustic wave solidly mounted resonator (BAW-SMR). Differing adoptions by OEMs like Apple, Samsung, Oppo, Xiaomi will affect markets in the near term, Yole said.

STMicroelectronics, which was once a top-three MEMS market leader, dropped to sixth position in Yole’s 2024 ranking. It had a steady year as it continued to benefit from its position selling inertial sensors into the smartphone market, Yole said. ST is currently repositioning its MEMS offerings for augmented and virtual reality and wearable equipment in the coming decade.

Meanwhile, the Chinese MEMS sector is expanding rapidly, driven by state-funding and a desire for self-sufficiency amid global tensions. The MEMS sector is not considered to be near the leading edge and until recently was an application for which Chinese companies could acquire chipmaking equipment. However, as in other sectors, a Chinese investment spurt risks triggering oversupply, fierce price competition and raises questions over the sustainability of individual companies.

Related articles:

ST Charges its Edge AI Push with Biosensor MEMS

How a Small MEMS Foundry Crashed the CHIPS Act

MEMS Microspeakers Target ‘Smart’ Hearables

Peter Clarke is a veteran reporter and analyst covering the global electronics industry. He is a regular contributor to TechSplicit from his base in the United Kingdom.

Copyright permission/reprint service of a full TechSplicit story is available for promotional use on your website, marketing materials and social media promotions. Please send us an email at talktous@techsplicit.com for details.